Try NFL Sport Channel Seach:

Selected searches:

NFL Football Players Draft Injuries Rookies Season SuperbowlItems by

NFL: Examining the In-Season Correlation of Defensive Performance

Published: October 10, 2009

Riddle me this: If many a fantasy analyst proclaim that it’s very difficult to predict how a defense will do before the season, then how much stock should we put into early-season performance?

Think about it. Is it at all likely that said defense will perform up to those numbers the rest of the season if they are so unpredictable and inconsistent?

Moreover, during which week of the season is it easiest to predict a defense’s stats for the remainder of the year? In other words, can you better predict the final 12 games using the first four, or the final four games using the first 12?

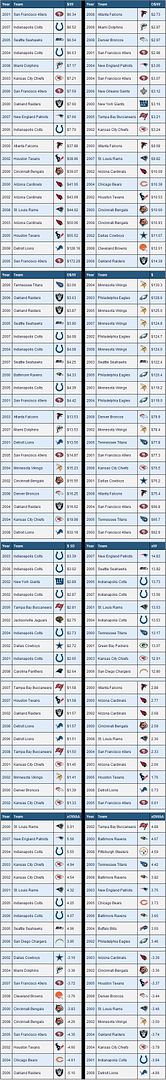

I looked at every team’s game-by-game stats since 2002 (gathered from pro-football-reference.com) to investigate. I compared defensive stats prior to and after a certain point of a season, as described above, as well as splitting up teams into four quartiles and seeing how each group performs the rest of the way.

First up is the relationship between in-season defensive performance. I found each team’s stats up to and after each game played (for instance, the average points allowed in the first three games and the final 13 games) and compared the two using correlation and average absolute error.

Quick explanation: Correlation is a number between one and negative-one that describes how close a set of values are related. A negative number, in this case, would mean that the more points allowed in the first half of the season, the less allowed in the second half, and vice versa; a positive number means that a team that allows a low number of points in the first half will also allow a low number in the second half.

The further the correlation away from zero, the more the two sets of data are related.

Average absolute error (AAE), on the other hand, is much easier to understand; it’s essentially the average difference between each of the two data sets.

The tables below show this data. The higher correlation and the lower AAE, the better the relationship is for each stat.

(The first row reads: The correlation between points allowed in a defense’s first game and points allowed per game in their remaining games played is .165.)

A lot to digest there. First of all, take a look at the correlations for passing yards and rushing yards. The highest correlation for passing yards is .211, after five games, whereas the correlation for rushing yards after just one game is .227.

In other words, it’s easier to predict a team’s rushing yards allowed for the rest of the season using just one week of data than it is to predict passing yards allowed at any points of the season.

Although sample size gets larger as the season goes on, that doesn’t mean that the autocorrelation—the correlation with itself—of each stat does too. After 15 games, you have a large amount of data, but there’s only one game left in the season.

The data show that the autocorrelations and AAEs for each stat are at their highest and lowest, respectively, near the middle of the season, when there is an equal number of games in each bucket.

Let’s now move our attention to our next topic. I split all 192 team-seasons into four quartiles based on their defensive performance after four, eight, and 12 weeks (one quartile is eight teams per year).

I then averaged the stats of all teams in each quartile the first N weeks (four, eight, or 12) and the remainder of the season. Are the best teams early in the season the best teams for the rest of the season?

(The first row reads: After four weeks, teams in the first quartile—those with the lowest in each stat—allowed 13.1 points per game, and they allowed 20.0 per game the rest of the season.)

Through four games and eight games, points allowed have a clear but weak autocorrelation, as the four quartiles finish in the same order the rest of the season.

But after 12 games, there’s no relationship at all—the teams in the fourth quartile allow almost as few points in the last four games as teams in the first quartile.

This is especially key for fantasy owners who look at a player’s schedule in the final weeks of the season during the fantasy playoffs.

As the first table shows, pass yards allowed does not have as strong an autocorrelation as rush yards allowed.

For each week, the quartiles’ pass yards does not line up for the remainder of the season; after four games, for instance, teams in the third quartile allow five less yards per game through the air as the second quartile.

This is not the same for rushing yards. Teams that are at the top or bottom of the league in rush yards allowed through four, eight, or 12 games usually are at the top and bottom, respectively, the rest of the season; after 12 games, in fact, teams regress only 45 percent to the mean in the final four weeks.

Turnovers face the same problem as passing yards—the third quartile (actually those with the second-most takeaways) has more takeaways than the fourth quartile the rest of the season at each interval.

Though the data isn’t divided into interceptions and fumbles, I can tell you that both have little autocorrelation from additional research: Interceptions have a year-to-year correlation of .09, and for fumbles recovered the correlation is .13.

Read more NFL news on BleacherReport.com

NFL: Regression to the Mean, Sample Size, and In-Season Projections

Published: September 12, 2009

What if I told you that Adrian Peterson isn’t as good as his stats say?

My reasoning is the Curse of the Leading Rusher. You’ve never heard of it before, but it’s an obvious trend. Since 1980, the NFL’s leading rusher has seen his rushing yards fall by 489 yards and his YPC by almost half a yard just one season later. Only six of the 31 leading rushers even increased their rushing yards the following season, and nine had less than 1,000 yards.

Convinced? You shouldn’t be. Their decline is nothing more than regression to the mean and a lack of sample size. Let me explain.

Regression to the Mean

Regression to the mean—also known as the law of averages—is the phenomenon that explains why extreme seasons far from the average (such as a passer rating over 100 or below 70) tend to be closer to the mean the following year.

It’s why we see the leading rusher put up worse numbers the next year, why quarterbacks don’t put up 40 touchdowns in back-to-back years, and, yes, why the Curse of 370 is a myth. Of course, regression to the mean also affects those on the bottom end of the spectrum—Brett Favre won’t throw 22 interceptions again, partly from regression and partly because his past numbers have always been better than last year’s.

Which brings us to the next principle: True score theory. True score theory states that a player’s observed performance is a combination of his true talent level and random error (or “luck,” in layman’s terms). Any time we see a player’s production in a certain time frame (one year, three years, or 10 years, for instance), we expect that his actual true talent level is somewhere in between the observed performance and the league average.

Let’s look at an example. I split all quarterbacks since 1980 into four quartiles based on their fantasy points per attempt, such that the top passers went into one group and the worst went into another. I found the average fantasy points per attempt for each quartile, and then compared that number to the group’s collective next-season value.

The graph below shows this with fantasy points per attempt divided by the average to create an “index value” (where 1.00 is average).

As the blue lines indicate, the quartiles regressed 63 percent to the mean as a whole. In comparison, should Drew Brees regress that much this season, he would have a 50-point drop in fantasy points, which would’ve put him at No. 8 among passers last season. (Of course, that’s assuming no one else would regress.)

I know what you’re thinking. That’s one year of data; of course they’ll decline. Yet regression to the mean even occurs for running backs with three straight 1,000-yard seasons: Those 99 backs averaged over 1,340 yards each of their first three years—with a yards-per-carry rate between 4.33 and 4.36 each year—but they had just 1,161 yards with 4.21 YPC in the next year; almost one-third (32) had less than 1,000 yards to boot.

In other words, those 99 rushers regressed about 45 percent to the mean, which may seem large, but my calculations would’ve predicted a 42 percent regression. That said, their regression was 18 percent less than those of the quarterback example above.

The more sample size we have, the less regression to the mean there is and the more certain we are that observed performance is close to a player’s true talent level.

And that brings us to the next topic.

Sample Size, Past Performance, and Mid-season Projections

Most fantasy football players create their own set of rankings usually based on hours of research and trends. So, explain to me why their prognostications should change drastically halfway through the season?

It’s not just Average Joes that do this either. ESPN’s Christopher Harris, for example, ranked Peyton Manning as his No. 2 quarterback in the preseason, but after Week Seven he had dropped Manning all the way down to No. 7.

Manning was 13th in fantasy points (with a quarterback rating just over 80) after seven weeks, but in the final 10 weeks of the season, he was the No. 4 quarterback and had a 105.2 rating, highest among qualifiers.

The moral of the story: Half a season is not enough to warrant a major change in your preseason rankings!

Curious, I went about calculating the change in true talent for players who had a considerable difference in production during the first half of the season compared to their preseason projection. I’m only looking at overachievers, but these numbers also hold for first-half disappointments.

I chose one player at each skill position whose 2009 FEIN projection was equal to a low-end starter in fantasy leagues (Matt Ryan, Larry Johnson, and Eddie Royal) and assumed they were to exceed their preseason projection by 15 percent in the first half (yet with no difference in projected attempts or catches).

Then, based on their projected first-half attempts, I calculated the amount of regression for each player: With 250 first-half pass attempts, for instance, Ryan would be expected to regress about two-thirds back to his preseason forecast in terms of yards per attempt. (I regress to their preseason projection as a shortcut to calculating a whole new set of projections.)

The results indicate that, with 15 percent higher production than expected in the first half of the season, Ryan would only perform 5.4 fantasy points above his preseason projection in the second half, compared to 2.7 for Johnson—including receiving numbers—and 3.4 for Royal.

To further justify the results, the full-season difference between Ryan’s preseason and mid-season projections would not have moved him up a spot in last year’s rankings. (The 10.8-point difference—5.4 doubled—would have increased his 2008 fantasy points from 196 to 206.8, but he would have ranked No. 13 among passers either way.) For Johnson, his outburst would have moved him up just one spot, from 29 to 28, and Royal would have moved two spots to No. 17.

At what point should you adjust your estimate of a player’s true talent? Well, if they overachieved by 15 percent for the first 16 weeks, Ryan’s updated projection would be 16.3 points higher over a full season than his preseason projection (which wouldn’t have moved him up a spot last year), Johnson’s forecast would be 8.4 points higher than expected (a two-spot jump), and Royal’s 9.3-point disparity would have moved him from No. 19 to No. 15.

As a general rule, it takes 21 games for a quarterbacks’ fantasy points to regress 50 percent to their previous projection, as well as 29 to 30 games for a running back and 13 to 14 games for a wide receiver. (The values for quarterbacks and running backs were found assuming there wasn’t a newly calculated projection after 16 games.)

In other words, only for wide receivers should you weigh current-season production more than their preseason projection at any point in the season. That doesn’t mean you should disregard current performance, only that it shouldn’t have as much weight as it usually does when you make trades or waiver-wire pickups.

Remember: If you have a player like Peyton Manning, for whom we have years of stats, then in no way, shape, or form should your opinion of him change after half a season, much less 20 games. Sample size is not your friend, and neither is regression to the mean.

This article can be seen at FeinSports.com and FFWritersWithHair.com.

Read more NFL news on BleacherReport.com

NFL: How Breakout and Breakdown Seasons Affect Future Performance

Published: August 31, 2009

To say that Seahawks quarterback Matt Hasselbeck was a bust last year is an understatement.

Hasselbeck had finished in the top six in quarterback fantasy points three of five years from 2003 to 2007; fantasy owners were expecting another good season, as he was drafted as the No. 9 quarterback in standard leagues.

Injuries and poor performance plagued Hasselbeck. Just one year after throwing for career-highs in yards and touchdowns, he set career-worsts in passer rating (57.8), completion percentage (52.2), interception percentage (4.8), and yards per attempt (5.8).

This year, despite his team’s acquiring former Pro Bowl receiver T.J. Houshmandzadeh, Hasselbeck’s average draft position puts him as the No. 15 quarterback.

Should his regression affect his 2009 performance that much? Or is he the top-10 quarterback we saw in previous years?

Naturally, this question applies to breakthrough performances, too. Panthers running back DeAngelo Williams finished as the No. 1 back in fantasy with 1,515 yards and 18 touchdowns last year.

He increased his yards per carry by 11.5 percent and his rushing touchdown percentage by 137 percent from his 2007 stats.

Drafted on average as the No. 9 running back, the consensus is that Williams will fall back some from his 2008 numbers.

Regression to the mean should obviously kick in for Williams, but it’s unseen as to whether his two good-not-great seasons will have any value in our 2009 ranking for him.

Before any analysis, we must first define a breakout. My criterion for a breakout season is a 15 percent increase in fantasy points per attempt or reception—or quarterback rating—over their highest value in the previous two years, and a breakdown season is one in which there is a 15 percent decrease from the minimum value in the previous two years, while staying on the same team each year.

For instance, there have been 37 running backs since 1980 to have a breakout season after two good-not-great seasons, as was the case for Williams; they saw a 19 percent drop in their fantasy points per carry (FPPC) the year after their breakout, regressing almost 75 percent back to their pre-breakout performance.

Yet there’s a selection bias in that sample. Those 37 running backs’ fantasy points per carry was almost 30 percent higher than average in their breakout season, and we’d expect regression to the mean to kick in regardless of whether they broke out.

So, I compared those 37 backs’ performance in the year after their breakout to a baseline performance: The next-year performance of all running backs with a similar FPPC average.

That is, the next-year performance among all running backs since 1980 with a FPPC within 0.015 points of the FPPC average in the 37 rushers’ breakout season was nearly equal to the breakout-backs’ next-year performance—less than one-tenth of one percent higher.

In other words, the fact that there was a breakout—as well as the fact that those 37 backs had almost league-average production in the two years before the breakout—made no difference in their next-year production.

They would have regressed to the mean just as much if they had performed at their breakout level for three straight seasons.

Let’s see how those numbers compare to other positions.

Quarterbacks

To clarify my criteria, I looked at all quarterbacks with 150 attempts in three straight seasons and found all passers who had a breakout or breakdown season in either their first or third years.

Players who fall under the “in the first year” status include Jim Kelly as a “breakout” (97.6 rating in 1991, followed by two near-80 ratings) and Ken Anderson as a “breakdown” (66.9 passer rating in 1980, followed by two above-90 ratings).

The first table below shows QBs who had a breakout or breakdown season—compared to the two seasons prior—as well as their post-breakout or breakdown passer rating, and the baseline performance (the average next-season rating of all QBs with a passer rating within five points of the breakout- or breakdown-season rating).

What the table means: The 43 passers who broke out had a 74.5 rating two years before their breakout, a 75.4 rating one year prior to the breakout, and a 92.3 rating in their breakout season.

The 43 passers had an 83.8 rating the year after the breakout, while the baseline performance was an 86.8 passer rating.

That means that the 92.3 rating they had in their breakout season had no effect on their next-season rating; they regressed more than normal, since they had had two mundane passer ratings the two years before the breakout.

The same occurs for breakdowns, though the difference isn’t as pronounced; because of the two good seasons prior to their breakdown, broken-down passers tend to bounce back more than a quarterback with similar stats.

Let’s see how these stats compare to the quarterbacks whose breakouts or breakdowns came in the first year of a three-year stretch.

There were 26 passers who posted a passer rating that was 15 percent greater than either of their next two seasons’ ratings. One season later, their collective ratings were six points higher than the baseline rating we expected.

The 10 percent increase in passer rating from year three to year four is astonishing. The baseline performance is almost equal to the 26 quarterbacks’ weighted rating in those three years (weighting each season as half as significant as the next returns a 79.4 rating).

Instead, it rises to 84.8, but that rise isn’t all credited to their breakout in the first year. The two years prior to that “breakout,” the 26 quarterbacks had ratings above or just below 90.

That suggests that the passers were slightly lucky when their ratings were in the 90s for three years, unlucky the next two years, and finally regressed back to their true talent level of 84. (Indeed, the following year, their passer rating held steady at 83.7.)

As for the 47 passers in the other group, their breakdown in the first year was a factor in their year-four passer rating.

They had a weighted passer rating average of 83.9 in the first three seasons, which would have risen to 86.2 had they put up a rating of 84 in the first year.

That’s a difference of 2.3 points—also the discrepancy between the baseline performance and their year-four passer rating.

On the other hand, there’s no effect if I look at quarterbacks with a breakout or breakdown season in the first season of a four-year stretch (despite the small sample size).

There were only seven quarterbacks who fit the breakout requirement; they had a decline in passer rating each year after their 100.1 rating.

The 27 passers who had a first-year breakdown produced a year-five rating that was just fractions below their expected performance.

The more attempts they racked up (in years two through four), the more we were certain that their true talent level was in the mid-80’s.

Conclusion

Quarterbacks whose breakout or breakdown occurs in the final year of a three-year stretch regress more to the mean compared to a baseline expectation.

The difference is equal to about two points of quarterback rating, with a larger regression for breakouts than breakdown performances.

The 26 quarterbacks whose breakout came in year one had their rating drop 15 points, stay in the high 70’s, then regress back to the low-to-mid 80’s.

Their up-and-down performance leads to a valuable notice: We always expect that a player’s true talent level is equal to his sample performance plus a regression to the mean.

Quarterbacks who have a breakdown season in the first year of a three-year stretch have a more dramatic decline after the third season than their baseline, owing to the breakdown performance; if those passers had a passer rating of 84 instead of 67.8 in the first season, we would expect their fourth-year production to be equal to that of the baseline.

2009 cases: Matt Hasselbeck, third-year breakdown.

Running Backs

Let’s see how the quarterback data compare to running backs. Only running backs that had 100 carries in three straight seasons are included. Fantasy points per attempt are prorated to 250 attempts in the tables below.

While it seems surprising that breakout rushers performed to their expectation the next year, the 37 backs had such a large increase in fantasy points per 250 attempts (FP/250) in their breakout season (29 percent) that their weighted FP/250 is 174, enough to suggest that the remaining 13-point decrease is from regression to the mean.

Running backs that broke down performed eight percent better than their baseline expectations the year after their breakdown, jumping from 135 to 150 FP/250. Although their FP/250 fell two straight years, their weighted FP/250 (154) predicted otherwise.

Now, what about backs whose breakout or breakdown came in the first year?

The first year of the three-year stretch affected both groups of running backs, though it wasn’t as profound for the breakdown group.

The 52 breakout backs had a five-point increase from the third to the fourth year, while the baseline suggested a five-point drop was in store.

Again, the weighted average (157) predicted their next-season performance better than the breakout itself.

Running backs whose breakdown occurred in the first year of a three-year stretch had a 13 percent drop in production from the third to the fourth years.

That, however, isn’t such a large decrease, since the baseline was an 11 percent drop. That said, the three-point difference in FP/250 is hardly significant.

When we look at four-year stretches with a first-year breakdown, the final-year FP/250 is equal to the baseline performance, at 163 FP/250.

The 16 backs that apply had 133 in their down year, followed by three years of FP/250’s in the 170’s, and then 163 a season later, as shown below.

Conclusion

A breakout or breakdown in the final year of a three-year stretch has no extra effect on a running back’s future production, compared to a baseline expectation.

Breakout backs performed to their baseline, and breakdown backs had 11 more FP/250 than expected.

When the breakout occurs in the first year, however, there’s a 10-point difference that is clearly influenced by the first-year 199 FP/250 rate. There’s no evidence that a breakdown in the first year has any effect on the year-four FP/250.

2009 cases: DeAngelo Williams (third-year breakout); LaDainian Tomlinson, Marion Barber, Joseph Addai, and Fred Taylor (third-year breakdown); Maurice Jones-Drew, Barber, Frank Gore, Steven Jackson, Clinton Portis, Larry Johnson, and Willie Parker (first-year breakout); Williams, Ronnie Brown, and Chester Taylor (first-year breakdown).

Wide Receivers

How do the receivers stack up? I looked at wide receivers and tight ends with 30 receptions in three straight seasons, and the results aren’t shocking.

Here are the data for breakouts and breakdowns in year one. Fantasy points per catch is prorated to 70 receptions (FP/70).

Breakouts and breakdowns for receivers aren’t much different from quarterbacks and running backs, and the disparity between actual and expected performance is much greater for wideouts.

The 89 breakout receivers were 13 points worse than their expectation, which was also nearly equal to their weighted average FP/70 of 149.

Those 89 receivers had a 17.5 percent drop in production from their breakout season to the next, compared to their expected drop of 9.6 percent.

The breakdown group reminds us that a weighted average of past performance is always more accurate for future forecasts than one year alone. Their 117 FP/70 in their low year was expected to be followed up by 125 FP/70, but their three-year weighted average of 133 FP/70 was right on the dot.

There’s an interesting contradiction when we look at first-year breakouts and breakdowns. One table gives one conclusion, but the other says otherwise. The first table shows data for three-year stretches…

And the next table shows data for four-year stretches.

Both tables tend to agree on first-year breakouts; each suggests a three- or seven-point difference in FP/70 between actual and the baseline performance.

But it’s the breakdowns that are fascinating. One table—the three-year stretch—says that receivers with a first-year breakdown perform five points worse than the baseline.

The other, though—looking at four-year stretches—says that the same receivers produce four points better than expected.

We’re arguing semantics, however. Both tables are most likely correct, considering the samples they use: If a receiver has three good seasons after a bad year, the down year (which is four years ago) is outnumbered by the good years and has so little weight in determining the player’s true talent level.

Chances are his true talent lies closer to the three stellar years as opposed to the poor season.

Conclusion

Third-year breakouts and breakdowns for receivers have much less weight compared to other positions in their future production.

As always, a weighted average of past production is better at predicted next year’s stats than on season (the breakout or breakdown) alone.

Wideouts with first-year breakouts perform about three points better than expected. Those with first-year breakdowns, though, tend to play better or worse than expected, based on which group you’re looking at.

With just two seasons of data after a breakdown, receivers perform five points worse than the baseline, but they are four points better than expected with three years of stats after their breakdown.

2009 cases: Derrick Mason, Deion Branch, Steve Smith (NYG), Mark Clayton (third-year breakout); T.J. Houshmandzadeh, Chad Ochocinco, Plaxico Burress, Dallas Clark, Chris Cooley, Heath Miller, Desmond Clark (third-year breakdown); Santana Moss, Josh Reed, Clayton, De. Clark, Owen Daniels (first-year breakout); Andre Johnson, Greg Jennings, Kellen Winslow (first-year breakdown, three-year stretch); Ike Hilliard (first-year breakdown, four-year stretch).

2009 Fantasy Football Projections: Peyton Manning’s Downfall

Published: August 10, 2009

It’s the middle of August, a time in which many fantasy football owners start to produce their rankings and cheat sheets. Some resort to intuition, while some take an expert’s rankings and tweak them. Others use hours and hours of research to create their rankings.

I’ll use projections.

My FEIN projections (short for Forecasted Evaluative Impartial Numerical projections) aren’t based on intuition or an expert’s rankings or even hours of research. Mine are based on complex algorithms with no human interaction—I input a player’s stats, and out spits their forecast.

The Method

Some of you may be wondering how I control for players switching teams or wide receivers losing a top passer, such as Jay Cutler and Brandon Marshall.

I don’t; I only adjust for players who switch conferences. While I could account for this by using air yards, I could only find yards after catch for quarterbacks for the current year, and there was no data for any previous seasons.

The basic steps for any projection system, as well as these, are:

1. Weight each season;

2. Regress each player’s stats to the mean;

3. Adjust for age.

The FEIN projections look at every player-season since 2002. Each stat—passing yards per attempt, interceptions per attempt, etc.—are weighted differently. I looked at all five-year stretches since 1980 and performed tests to see which weight results in the lowest error between actual performance and projected performance.

For instance, completion percentage is weighted as 0.5, meaning 2008 would have a weight of one, 2007 would have a weight of 0.5, and so on down to a minuscule weight of about 0.016 for 2002, whereas interception percentage has a weight of 0.9.

Before I do that, however, I first adjust each player’s stats to a neutral conference. Since 2002, players moving from the AFC to the NFC mid-season or in the offseason have a 2.1 percent increase in passing touchdowns, so I adjust each AFC player’s passing touchdowns down by 1.1 percent (the square root of 2.1 percent, to get them to a neutral conference).

Then, instead of regressing a player’s stats to the league average, I regress it to their height or weight (or BMI). I did further research to follow up my article on height and weight and found that the only stats that are not affected by height or weight are completion percentage, pass yards per attempt, and pass touchdowns per attempt. I regress the first two to the league average, while I regress the third to completion percentage and interception percentage.

What do I mean by that? I found that completion percentage actually predicts future touchdown-to-interception ratio better than that stat itself, and I already saw a relationship between weight and interceptions, so I project first completion and interception percentage, and use that to project touchdowns.

(Side note: The amount I regress each stat to the mean or to height and weight depends on the year-to-year consistency in each stat. What I mean is that completion percentage is more stable than any other passing stat, so a quarterback won’t be regressed as much for completion percentage than interception percentage.)

I then age adjust, adjust for strength of schedule, and then re-adjust for the player’s 2009 conference.

Strength of schedule adjustments admittedly don’t have that much effect; I regress each team’s 2008 defensive stats to the mean (so much so that the Steelers’ 13.9 points allowed per game rises to 18), total up the passing yards per attempt for each team’s 2009 opponents, and then normalize for the league average (such that a team whose opponents allowed a combined 6.7 yards per attempt with a league average of 6.8 YPA would have a YPA factor of 0.985).

I also project rookies as if they were 2008 rookies. Their “2008 stats” are solely based on their projected attempts or receptions. That is, we know that a running back with 200 attempts usually has a higher YPC than one with 100 attempts, or else he wouldn’t have gotten 200 attempts.

So, I looked at all players post-1980 within 20 pass or rush attempts or 10 receptions of each rookie’s projected playing time and found the average stat line of the players in that group. (As expected, the running backs with more attempts had a higher YPC than low-carry backs. Running backs with 188 to 228 attempts—Chris Wells is projected to have 208—averaged one-tenth of a yard more per carry than those with 51 to 91 carries—Glen Coffee is projected to have 71.)

Once I have that, I run the rookies through the same process as everybody else.

The Projections

I cheated a little, as projected playing time is an average of ESPN’s, CBS’s, and FFToday’s projected attempts and receptions.

For those without a projection and who played in 2008 (plus Michael Vick), I assigned 20 pass and five rush attempts for quarterbacks, 20 rush attempts and five receptions for running backs, five receptions for tight ends, and 10 receptions for wide receivers.

In the spreadsheet below, overall rank is determined as a player’s VBD, or fantasy points over baseline. My baseline was the number of each position picked in a standard, 192-player draft—24 quarterbacks, 57 running backs, 18 tight ends, and 59 wide receivers.

Some players have “xxx” beside their team and bye week; these players either didn’t play in 2008 or are currently a free agent or retired (in the cases of Vick and Brett Favre).

Without further ado, here are the top-10 in fantasy points at each position. Click here to see the full list.

| Player | Pos | Comp | Pass Att | Pass Yd | Pass TD | INT | |

| Drew Brees | QB | 378 | 607 | 4255 | 33 | 18 | |

| Tom Brady | QB | 350 | 553 | 4001 | 29 | 16 | |

| Aaron Rodgers | QB | 340 | 550 | 3946 | 29 | 17 | |

| Kurt Warner | QB | 354 | 540 | 4106 | 29 | 16 | |

| Philip Rivers | QB | 319 | 513 | 3772 | 29 | 16 | |

| Peyton Manning | QB | 345 | 533 | 3796 | 27 | 15 | |

| Tony Romo | QB | 305 | 496 | 3662 | 28 | 17 | |

| Matt Cassel | QB | 316 | 500 | 3561 | 22 | 13 | |

| Jay Cutler | QB | 306 | 495 | 3615 | 22 | 14 | |

| Matt Ryan | QB | 310 | 501 | 3663 | 23 | 15 | |

| Player | Pos | Rush Att | Rush Yd | Rush TD | Rec | Rec Yd | Rec TD |

| Maurice Jones-Drew | RB | 247 | 1073 | 12 | 60 | 513 | 3 |

| Matt Forte | RB | 292 | 1168 | 10 | 55 | 424 | 5 |

| Adrian L. Peterson | RB | 321 | 1464 | 12 | 22 | 169 | 2 |

| Michael Turner | RB | 334 | 1438 | 15 | 8 | 48 | 1 |

| Steven Jackson | RB | 291 | 1203 | 10 | 48 | 401 | 3 |

| Steve Slaton | RB | 277 | 1241 | 9 | 49 | 385 | 4 |

| Clinton Portis | RB | 315 | 1330 | 11 | 28 | 213 | 1 |

| LaDainian Tomlinson | RB | 264 | 1105 | 12 | 43 | 321 | 2 |

| DeAngelo Williams | RB | 271 | 1235 | 13 | 22 | 139 | 1 |

| Chris Johnson | RB | 264 | 1196 | 9 | 43 | 312 | 3 |

| Player | Pos | Rec | Rec Yd | Rec TD | |||

| Tony Gonzalez | TE | 79 | 942 | 7 | |||

| Antonio Gates | TE | 70 | 839 | 8 | |||

| Jason Witten | TE | 80 | 940 | 6 | |||

| Dallas Clark | TE | 72 | 802 | 8 | |||

| Chris Cooley | TE | 73 | 800 | 6 | |||

| Greg Olsen | TE | 67 | 763 | 6 | |||

| Zach Miller | TE | 62 | 809 | 5 | |||

| Owen Daniels | TE | 64 | 786 | 5 | |||

| Kellen Winslow | TE | 67 | 750 | 5 | |||

| John Carlson | TE | 59 | 696 | 6 | |||

| Player | Pos | Rec | Rec Yd | Rec TD | |||

| Larry Fitzgerald | WR | 99 | 1418 | 10 | |||

| Calvin Johnson | WR | 84 | 1345 | 10 | |||

| Andre Johnson | WR | 105 | 1406 | 8 | |||

| Randy Moss | WR | 84 | 1191 | 11 | |||

| Reggie Wayne | WR | 92 | 1273 | 9 | |||

| Greg Jennings | WR | 79 | 1224 | 9 | |||

| Steve Smith | WR | 85 | 1288 | 7 | |||

| Roddy White | WR | 86 | 1261 | 6 | |||

| Vincent Jackson | WR | 71 | 1140 | 8 | |||

| Antonio Bryant | WR | 81 | 1203 | 7 |

You can download the above spreadsheet into Excel here.

The Counter-intuitive Forecasts

The projections aren’t going to be accurate for all 470 players. Here are some of those whose projections seem to go against the grain.

Peyton Manning

Peyton Manning finished in the top four in fantasy points at his position each year from 2002 to 2007, but he slipped to seventh last year. A more telling trend is this: Since his record-breaking 2004 season, both his yards per attempt and passer rating have fallen each year, from a 9.2 YPA and 121.1 rating in 2004 to last year’s 7.2 YPA and 95.0 rating.

The FEIN projections don’t take that into account, but Manning is projected to once again decline in both stats as well as finish sixth among quarterbacks in fantasy points, with this forecast: 64.7 completion percentage, 3796 yards, 27 touchdowns, and 15 interceptions.

Matt Cassel

Matt Cassel went from a career backup to earning more than Tom Brady in just one year, after passing for almost 3,700 yards with 21 touchdowns.

As I mentioned before, the projections don’t take into account any changes of coaching staff, personnel, or teammates, and Cassel is one who would be negatively affected with any adjustments for this.

Last year, 57 percent of Cassel’s passing yards came after the catch, while only 42 percent came after the catch for Kansas City quarterback Tyler Thigpen. Cassel’s raw YPA was a yard higher than Thigpen’s, but his air yards per attempt was less than Chiefs QB.

Since wide receivers have more control over YAC than quarterbacks, it’s likely that Cassel’s projected YPA of 7.1 is optimistic.

Clinton Portis

Clinton Portis’ projection isn’t actually odd at all; it’s just that too many fantasy owners massively underrate him.

Since his rookie season in 2002, Portis has finished outside the the top 10 in fantasy points among RBs just twice—he finished 11th in 2004 and 36th in 2006, when he only played eight games (double his fantasy points and he would finish ninth).

Portis has had one sub-1,200-yard season in his career—2006, when he would’ve finished with 1,000 yards if he played all 16 games. He’s also had two sub-nine-touchdown seasons in his career—2004, the year he finished 11th in fantasy points, and 2006, when he would’ve had 14 if he played all 16 games.

Just when everyone thought he was done, Portis had almost 1,500 yards and nine touchdowns in 2008.

His forecast of 1,330 yards and 11 touchdowns is nothing short of ordinary.

Anquan Boldin

Boldin finished seventh in fantasy points last year despite missing four games due to injury, and he finished the year with 1,038 yards and 11 touchdowns.

Boldin’s projection calls for a YPC rate of 12.4, in line with his past numbers. The seven touchdowns is a major drop from his touchdown percentage the last two years, but receiving touchdowns have a weight of 0.8—which means that 2004, 2005, and 2006 are weighted quite heavily in the forecasts.

We get a career weighted touchdown percentage of 8.9, or 7.2 touchdowns in his 81 projected receptions; that’s slightly less than his exact projection of 7.3 touchdowns.

As well, his No. 17 ranking among wide receivers may be due to his forecasted playing time. Give him 89 receptions, and he ranks No. 12 among wideouts.

Vincent Jackson/Antonio Bryant

Jackson and Bryant were the epitomes of late-round or waiver-wire grabs at the wide receiver position last year. Jackson, selected No. 41 among wideouts in 2008, provided owners with almost 1,110 yards and seven touchdowns. Bryant, taken No. 73, finished No. 8 among receivers, with 83 receptions for 1,248 yards and seven scores; amazingly, Bryant had a higher YPC in 2007 than in 2008.

Fantasy football owners certainly think they’ll both cool off, as Bryant and Jackson are being selected as Nos. 17 and 18 among receivers, respectively.

That doesn’t make sense, even if you discount their projections. Jackson is projected to catch 71 balls in 2009, 12 more than he had in 2008. Thus, he’d need a 25 percent drop in yards and touchdowns per catch (which would give him a new career low in YPC by over a yard) from 2008 to finish as the No. 18 receiver, if only because of his (projected) increase in receptions.

As for Bryant, he’s projected to get 81 catches in 2009. If he even ties his career lows in YPC and touchdown percentage, he’d still end up with 138.3 fantasy points—which would place him right ahead of T.J. Houshmandzadeh, who’s projected to end the season with 138 fantasy points and finish No. 18 among receivers.

I would not suggest you use the bare projections as your cheat sheet. The projections don’t take into account any changes in a player’s surrounding—save for a switch in conferences—and, as such, there’s going to be a lot more inaccuracy in the projections for players switching teams.

Is Matt Hasselbeck the No. 24 quarterback? Maybe he was before T.J. Houshmandzadeh signed with the Seahawks; it’s inevitable that Hasselbeck will outperform his projection, and the same could be said for Matt Ryan with Tony Gonzalez now on the team.

Size Does Matter: How an NFL Player’s Height and Weight Affects Performance

Published: July 16, 2009

Every year, it seems like a few talented college players are being snubbed out of the NFL because their measurables, in NFL draft speak—height and weight, for example—are poor. To wit:

• Missouri quarterback Chase Daniel finished fourth in the Heisman Trophy voting in 2007—the second-highest ever for a Tiger—and finished his college career with the most offensive yardage in Missouri history. He had over 13,000 total yards in his three full years as a Tiger, including over 4,300 passing yards in both his junior and senior seasons.

His completion percentage was 72.9 percent in his final season, in which he also had 39 touchdowns and 18 interceptions.

But scouting reports said that Daniel, measured at 6’0″ at the Scouting Combine, “lacks ideal height for an NFL quarterback.” Daniel went undrafted in the 2009 NFL Draft and is currently fighting for the No. 3 quarterback spot on the Washington Redskins.

• Northern Illinois running back Garrett Wolfe’s worst college season was his junior season. He gained a measly 1,580 yards on the ground with a dismal 16 touchdowns on 243 carries, pathetic numbers for a man who also missed three games due to injury.

Sarcasm aside, Wolfe gained over 1,600 and 1,900 yards in his other two seasons (the latter of which led the NCAA), but at 5’7″ and 186 pounds, Wolfe was drafted at the end of the third round to the Chicago Bears.

He hasn’t been given much opportunity to shine at all, with 46 career carries in two seasons in the NFL.

• The prototypical small guy, at 5’9″, Wes Welker failed to garner much attention after high school. A week after signing day, Welker received a scholarship from Texas Tech, when one of the Red Raiders’ projected signees chose a different school.

In his four-year career at Texas Tech, Welker had 3,475 total yards from scrimmage (rushing and receiving) with 23 touchdowns. His eight career punt return touchdowns set an NCAA record (since tied).

Welker went undrafted in the 2004 NFL draft; he signed with the San Diego Chargers but was ultimately cut after Week 1.

Nevertheless, Welker showed that small players can succeed in the NFL. After breaking onto the scene in 2006, with 687 yards on 67 receptions for Miami, he was traded to the Patriots. Welker ended up with a league-high 112 catches in 2007 followed up by 111 in 2008; he had over 1,100 yards as well each of those two years.

Others, such as 6’0″ Drew Brees—who, among many other accomplishments, threw for 5,000 yards in 2008—have proved that, when given the chance, size doesn’t matter.

In this article, I’ll be testing the effects of height and weight on seasonal and career production, split up by position.

Do taller quarterbacks have a higher completion percentage, on the notion that they can see over the line of scrimmage? Do taller wide receivers have an advantage over smaller receivers when it comes to yards and touchdowns?

As always, my data comes from Pro-Football-Reference.com. Unfortunately, I could only find height and weight data in the college section of P-F-R, so I went through the 212 colleges with 20 or more guys who played in the NFL and collected height and weight data from there. This gave me height and weight data for all but 898 of the more than 10,000 player seasons since 1980 (and career data for all but 227 of the more than 2,300 player careers).

Now, I don’t know the source of P-F-R’s height and weight data; I presume it is the numbers given out by each team. This may have some drawbacks (smaller players will sometimes get a boost to their height or weight, for example), but in general it works.

The first measure of correlation between measurables and production is, well, correlation.

Correlation shows how relationship between two variables in a number between negative-one and one.

The more related two variables are, and the more the graph between the two looks like a perfect line, the closer to one or negative-one the correlation is; a positive number represents a positive relationship—that is, as one stat goes up, so does the other—and a negative number represents a negative relationship—when one variable goes up, the other goes down.

Since that probably made no sense, take a look at this graph, which shows the correlation of several sets of data. If, say, weight and completion percentage forms a straight line rising to the right, the correlation will be one. If they form a straight line rising to the left, the correlation is negative-one. And if there’s no relationship whatsoever (a scattered mess), it’s zero.

I took the career statistics of every player post-1980 (with 300 career pass attempts, 100 rush attempts, or 100 receptions) and plotted them with their height and weight. Here are the results.

In this scenario, a positive correlation means that taller or heavier players have better statistics than shorter, lighter players, aside from interceptions, which is the other way around.

We see a small positive correlation between weight and most passing stats (all those except yards per attempt). In each case, as weight increases, the stat in question rises accordingly (or drops, in the case of interceptions).

The largest correlation between height and any passing statistic is, interestingly, between height and completion percentage, though the correlation is negligible.

There’s not much correlation between measurables and rushing statistics, with the obvious exception of weight and rushing touchdowns. Heavier running backs tend to be the ones who score the most touchdowns, which is what we expected.

Then there’s the wideouts. There’s a very strong correlation between weight and yards per catch, at -0.653, which means that, somewhat counter-intuitively, shorter wide receivers have more yards per catch than taller receivers.

The correlation is even more staggering when you consider that there were less than 100 unique weights for the more than 400 receivers in the study; it rises to -0.819 when you only look at the average yards per catch at each of those unique weights.

This, in turn, brings up a good point: If there are so few unique weights or heights (of which there were 14 between those 400 receivers), then looking at correlation coefficients won’t show the real relationship between measurables and on-field production.

In other words, in order to look at this relationship (or non-relationship), we must group receivers based on their height and weight and look at the statistics from the totals in each bin of receivers. I did this for each position, making sure each bin had a sufficient number of players in it (at least 40 or so).

Here are the results for quarterbacks. All heights are in inches and all weights in pounds.

A quarterback’s performance tends to be highest when the passer is 74 inches tall (6’2″), but this could also be contributed to the fact that, either coincidentally or not, Brett Favre, Joe Montana, Steve Young, and Kurt Warner were all 74 inches.

Removing that particular height, quarterback rating increases at each height increment. As well, completion percentage for the shortest quarterbacks is lower than any other height, a full point lower than the tallest players’ completion percentage.

That said, there’s no real pattern between height and completion percentage beyond that.

The largest correlation comes from weight and interception percentage. Interceptions decreased each time weight increased, with a steep decline from quarterbacks weighing over 215 pounds.

I’m hypothesizing here, so bear with me, but heavier quarterbacks may be more inclined to take a sack under pressure, whereas lighter ones will instead throw the ball up to evade a sack.

I don’t have sack data, so I can’t test this hypothesis. This may be, however, just a correlation/causation issue—in other words, there may be another outside factor affecting interceptions.

In addition to looking at the average statistics at each height or weight, I also looked at the chance of a “great” season, by looking at the odds of finishing in the top quarter in that particular stat.

I only included seasons where the quarterback had 350 pass attempts. Here are the results.

Does this confirm the myth? Again, excluding 6’2″ quarterbacks, completion percentage increases each time height does as well.

Taller quarterbacks also have higher odds of reaching the top quartile in yards per attempt than their smaller counterparts; 6’5″ passers reach that twice as often as 6’1″ quarterbacks.

We also see that the chance of having a great season in touchdowns per attempt decreases each time weight increases. We didn’t see this trend in the first quarterback graph, however, so I’d say that that is just a mere coincidence.

Backing up our previous conclusion, the probability of throwing for 12 or less interceptions more or less increases as weight goes up.

I then examined the predictive power of height and weight. I looked at all QBs who stayed with the same team and had 300 pass attempts in three straight years, then ran a regression using past two years of data plus height or weight to predict the third year.

For example, quarterback rating is equal to 0.373 * (last year’s rating) + 0.153 * (rating two years ago) – 0.684 * (height) + 91.246. That means the difference between a 73-inch and 77-inch quarterback’s passer rating is equal to (77 – 73) * (-0.684), or 2.74 points of quarterback rating, favoring the smaller passer (the coefficient for height is negative).

Weight affects passer rating by 1.15 points, favoring heavier QBs. Smaller QBs have an 8.82-fantasy-point edge over taller QBs over the course of 450 pass attempts, though weight had a much lower affect on fantasy points (2.21 points, favoring heavier QBs).

Completion percentage wasn’t changed by height or weight much at all. Passing yards, touchdowns, and interceptions favored smaller quarterbacks, yet touchdowns and interceptions also favored heavier QBs.

Almost every stat favors both small (height-wise) and heavy quarterbacks. I then ran the same test using body mass index, or BMI, which is an easy-to-use statistic that identifies a player as underweight, normal, or obese. What we want to see is an edge toward obese players, guys who are heavy yet small in stature.

In fact, we see nearly the same results as before. The difference between a 73-inch, 200-lb and a 73-inch, 230-lb quarterback all favor the beefier passer: an edge of 3.16 points on quarterback rating, 8.39 points to fantasy points, a minimal change in completion percentage (one-half of one percent), 13.89 yards, 1.09 touchdowns, and 1.91 less interceptions.

It should be noted, however, that those 8.39 fantasy points were the difference between the Nos. 13 and 17 quarterbacks last year in terms of fantasy points.

So, when you’re in the late rounds of your draft, and you see Eli Manning and David Garrard both available, take the time to think about BMI: The difference between Manning’s BMI (26.5) and Garrard’s BMI (32.2) equates to a whopping 12 fantasy points in 450 attempts.

Now we’ll move on to the running backs. Here are the average stats at each height and weight group.

There’s a very strong correlation between height and yards per carry. We see a downward trend in yards per carry as height increases, with the exception of the jump from 74 to 75 inches tall.

This pattern is backed up by the relationship between weight and YPC; for each 10-pound bin, there is an average drop of 0.06 yards per carry (15 to 20 yards in a season for a full-time back).

And in fact, the difference between the YPC of the 68- and 73-inch backs (more than one-third of a yard) equates to 90 to 100 yards over the course of a season—the difference between the 11th- and 17th-ranked backs in terms of rushing yards last year, mind you.

There’s no relationship, on the other hand, between height, fantasy points, and touchdown percentage.

As well, the correlation between weight and rushing touchdowns is small but apparent, as touchdown percentage increases somewhat as does weight. The difference in touchdown percentage between the small and heavy backs equates to two touchdowns in a full season, roughly the difference between the 12th- and 17th-ranked backs in terms of fantasy points last year (an average No. 2 back as opposed to a borderline No. 1 RB).

Let’s compare the above table with the one below, which shows the probability of finishing in the top quartile. I included only those backs with 200 rush attempts.

There’s a slight correlation between height and rushing touchdowns, taking out the jump (again) from 74 to 75 inches, that suggests touchdowns fall as height increases.

We also see a very interesting pattern when looking at weights and fantasy points. There’s a downward trend when it comes to the odds of finishing in the top quarter, as weight increases. Why?

The answer is fantasy points. Because of their subjective weights (10 yards for one point, six points for a touchdown), the average running back in the sample had 70 percent of his fantasy points come from total yards, which, obviously, benefits the small backs with a lot of yards but just a few scores.

Continuing on with the predictive value of height and weight, the difference between a 5’8″ and a 6’3″ running back is 5.9 fantasy points in 250 attempts—an advantage to the smaller back by less than 51 yards and three-tenths of a touchdown. (Yes, the coefficient for rushing touchdown percentage was negative, but so small that it’s negligible.)

When looking at weights, we see that the lighter backs have a 2.39-fantasy-point and an 18-yard edge over their heavier counterparts, while the heavier rushers have a 0.55-touchdown difference.

Unlike quarterbacks, height and weight seem to show the same conclusions for running backs, that shorter, smaller backs perform better. Thus, looking at BMI—which divides weight by height—will essentially neutralize the height/weight issue.

(This, in fact, is true, as the difference between the highest and lowest backs in BMI is less than one fantasy points, five rushing yards, and one touchdown.)

For running backs, we need to multiply height and weight, to combine them into one statistic.

When we do this, we find that the difference between a 68-inch, 200-lb and a 75-inch, 250-lb back is 5.79 fantasy points and 46 yards in favor of the lighter back and less than four-fifths of a touchdown in favor of the heavy runner.

Nevertheless, this is what we expected in the first place: smaller backs get the yards, and the bruisers get the scores. In terms of fantasy points, the differences in rushing yards and touchdowns are nearly equal, but the five-plus advantage in fantasy points for the small guys comes from their receiving.

In addition, another thing that may benefit the smaller rushers is the fact that yards may be a greater function of skill than touchdowns, considering that it only takes a good quarterback to move the offense into the five-yard-line for a back to get a score.

Think about getting a small, fast runner like Leon Washington instead of a bruiser like Le’Ron McClain or Tim Hightower heading into the latter rounds of your draft. Washington’s receiving, as well as the fact he may get a few gratuitous touchdowns, may vault him over McClain or Hightower.

Now, let’s look at receivers—both wideouts and tight ends. Here are the statistics of each group of receivers.

There’s a clear correlation between measurables and production for wide receivers, and it’s not what you may have thought: shorter, smaller receivers perform better than taller, larger wideouts.

Shorter receivers have a higher yards-per-catch than taller receivers, though the pattern isn’t as noticeable as the relationship between weight and YPC; we see that yards-per-catch falls each and every time weight increases. The difference between the lightest and heaviest wideouts is 4.37 YPC, which equates to over 300 yards for a starter with 70 catches.

Keep in mind that those extra 30 fantasy points were the difference between the Nos. 8 and 19 receivers in terms of fantasy points, and the 300 yards were the difference between the Nos. 6 and 21 receivers in receiving yards last year.

There is, however, a slight positive trend regarding height and touchdown percentage, in that taller receivers have a small benefit over shorter ones. But the effect of height on touchdowns doesn’t cancel out yards per catch—smaller receivers still have more fantasy points per catch than taller wideouts.

That doesn’t hold steady, though, when looking at weight and touchdowns; there’s no relationship whatsoever between the two variables.

Now we’ll examine the chance of producing a season in the top quarter, including only those receivers with 60 receptions.

Looking at the table, we don’t see any trend based on height and fantasy points. But when we split it up based on groups of three, we do: Wide receivers less than 71 inches tall finished in the top quarter of fantasy points 27 percent of the time, compared to 25.5 percent for wideouts between 72 and 74 inches and 22.5 percent for those greater than 75 inches.

Doing this for both yards per catch and touchdowns per catch, we see the obvious—YPC goes down as height increases, and touchdowns goes up as height goes up.

(By the way, the difference in those odds in YPC between the tallest and shortest receivers is 8.2 percent, while that number is 2.3 percent for touchdowns per catch. This suggests that it’s easier for shorter receivers to have a good season in touchdowns than it is for taller receivers to have a good season in terms of yards per catch.)

There’s a loose correlation between weight and yards per catch, while there’s not much relationship between weight and touchdowns.

The receivers above 241 pounds were all tight ends, so don’t look into the zeros too much.

Looking now into the forecasting power of height and weight for receivers, we see that, for receivers with 60 receptions in three straight years for the same team, height affects yards by only 7.86 yards in 70 receptions—benefiting smaller wideouts—while it affects fantasy points and touchdowns by less than one-fourth—both benefiting taller receivers.

Onto weight, we find that 180-pound receivers have a 6.55-fantasy-point and 37-yard edge over 230-pound receivers, as opposed to the 0.45-touchdown advantage the heavier receivers have.

It appears that height multiplied by weight will include both of those measurables into one statistic, and would be a better indicator than BMI, but that’s wrong; I did these tests with both stats, and BMI affects production much greater than height x weight.

The difference between a 5′ 9″, 180-pound receiver and a 5′ 9″, 230-pound receiver? A massive 16 fantasy points—82 yards and 1.24 touchdowns, both with the edge to the bonier wideout. Sixteen fantasy points was the difference between the Nos. 15 and 23 receivers in fantasy points last year.

Remember last week’s article regarding aging curves? I commented on how Ted Ginn Jr. could have a breakout season this year, as he’s turning 24.

Here’s more evidence that you should take him late in your draft: The 3.26 difference in BMI between him and highly-touted rookie Michael Crabtree, who is being selected 20 spots ahead of Ginn overall, equates to an advantage for Ginn of seven fantasy points, 36 yards, and half a touchdown.

Be sure to look at Ginn—as well as Cardinals receiver Steve Breaston, whose BMI is even two points less than Ginn—as possible sleepers at wide receiver in your draft.

NFL Aging Curves by Position: Rookie QBs, Third-Year WRs, and Age 30 RBs

Published: July 10, 2009

They say age ain’t nothing but a number.

Twenty-one, 26, 31—what’s the significance? Is age merely just a number, or a baseline for seasonal performance? How can we quantify this?

Aging curves—also called aging patterns or age factors—show the relative performance of a group of players for each age, usually either showing how much (in percentage terms) a statistic improves or declines from one age to the next, or how the production at any age compares to the peak age.

One method used for aging curves it to simply add up the stats for every player at each age and look at the resulting sums. This is flawed, however, for it doesn’t account for the fact that there are many more players at age 24 than at age 34—the difference in yards or touchdowns per attempt won’t offset the disparity in attempts.

You can solve this problem by dividing the sum by the number of players at that age, right? Well, technically, yes, but it’s still not enough.

There’s selective sampling issues using this technique: The players who rack up attempts or receptions at age 21 or 22—their rookie season—are usually the best players, and thus it would appear that a player’s first year or two is one of their best.

At 35 and 36, the only guys left are the ones who have had a very successful first 12 years of their career and, as a whole, are typically better than the average player at age 24 or 25…and thus, it would appear that a player also peaks very late in his career.

The solution is to look only at matched pairs: how each player performs from one year to the next. Instead of comparing the average production at age 24 to age 25, you see how those 24-year-olds do the very next year. This way, you are looking at the same players in back-to-back years; previously, not every player was the same in each sample.

So, if those set of 24-year-olds have a completion percentage of 60 percent, and at age 25 that rises to 63 percent, we are fairly certain that completion percentage is 1.05 times higher (63 divided by 60) at age 25 than at age 24.

But we’re forgetting the most important principle at hand: regression to the mean. Observed production is equal to a player’s true talent, plus luck or random noise. What we are trying to do is to eliminate that noise, because, in general, that luck goes away in the next year. (For instance, running backs with over 1,000 yards since 1980 average 6.23 yards per game less the following year, almost 100 yards in a full season.)

We want to regress a player’s Year X stats, but leave the Year X+1 stats alone. The question is, how much should we regress? I found that a quarterback with 512 attempts, a running back with 439 attempts, and a wide receiver with 45 receptions should have their yards per attempt or reception regressed 50 percent to the mean; there are different rates for completion percentage and the like, and the more attempts or catches a player has, the less he’ll be regressed.

Normalize each player’s two years based on the league average, and we’re finished.

Let’s see how these aging curves stack up for each position.

(Note: My data sample ran from 1980 to 2007. I looked at quarterbacks with 50 attempts, running backs with 30 attempts, and wide receivers with 20 receptions in Year X, no matter how many they had in the next year, because I weighed each of the players’ two years by the minimum number of attempts or catches in the back-to-back years. I excluded any players who switched teams mid-year or in the offseason.)

(Another note: Unless otherwise noted, aging curves shown are “chained” and then divided by the peak level. That is, if yards per attempt falls two percent every year from age 21 to age 30, then age 21 would be given a value of 1.00, age 22 would be 0.98, age 23 would be 0.98 x 0.98, or about 0.96, and so on until 0.834 at age 30. The numbers are then divided by the peak value, 1.00 at age 21. In other words, a player’s yards per attempt would be 83.4 percent of what it is at age 21.)

Quarterbacks

Some might say that a quarterback’s best years are in his mid-20s, pointing to common knowledge and the successes of Daunte Culpepper and even Marc Bulger. Others may bring up Tom Brady, Peyton Manning, Kurt Warner, and Brett Favre as guys who succeeded well into their 30s.

Who’s right?

To see this table in graphical form, click here . (The values are adjusted up or down slightly so the lines won’t collide.)

According to the table, a quarterback’s peak age is 25 for all but one of the stats, with 26 to 28 not far behind. There seems to be a steep, upward trend at the beginning of a quarterback’s career, and a gentler fall from their peak.

Notice how the curves of touchdowns and interceptions are much more extreme compared to completion percentage and yards per attempt, which have a moderate slope.

Not coincidentally, touchdowns and interceptions both have a worse year-to-year correlation than do completion percentage and yards per attempts—in other words, it’s more likely for a player to have abnormal numbers in TDs and INTs than in completions or yards.

A quarterback’s biggest statistical jump is from age 24 to age 25: Take a league-average 24-year-old, and the next year (in 450 attempts), he’ll add 1.6 points to his completion percentage, 67 passing yards, almost two touchdowns, and two-fifths of an interceptions.

That equates to 11 more fantasy points over the course of a season—or roughly the difference between the Nos. 13 and 19 quarterbacks last year.

Last year, Jay Cutler and Aaron Rodgers made the leap from their age-24 to their age-25 seasons. This year? Well, Brady Quinn is the only qualifying player who seems to have at least a part of the starting job locked up; Tyler Thigpen, Kevin Kolb, Drew Stanton, and Troy Smith round out the 25-year-olds.

Quinn showed some promise last year, throwing for 239 yards and two touchdowns in a Week 10 game against Denver (though he followed that up with 14 completions in 36 attempts for 185 yards at Buffalo). Think about picking Quinn late in your fantasy draft, and it could pay off.

Age isn’t the only way to split up quarterbacks; experience matters, too. Although an “experience curve” looks roughly the same as an aging curve, we see that rookie quarterbacks have a major increase in production to their sophomore season. (So much for the sophomore slump.)

Rookies had a four percent increase in completion percentage and yards per attempt, a five percent increase in touchdown percentage, and an eight percent decrease in interception percentage.

Both Matt Ryan and Joe Flacco would see a 10-point increase in fantasy points if those percentages held up. Those 10 points wouldn’t have moved Ryan up in his rank among QBs last year (in terms of fantasy points), but it would have moved Flacco from No. 19 to No. 14, right behind Ryan.

Though Ryan and Flacco may regress to the mean, the increase from their second-year experience may offset that regression.

Running Backs

Few running backs have had the late-career outburst that John Riggins did. Riggins had just one 1,000-yard season through age 28, before a miraculous career turnaround that included four 1,000-yard performances in the next six seasons, not including his 533 yards in eight games in the strike-shortened 1983 season.

From age 22 to age 28, Riggins had 4,655 rushing yards and 28 touchdowns; Riggins had 2,000 more yards and almost 50 more touchdowns from 29 to 36 in the same amount of time (he skipped his age-31 season due to contract disputes).

Let’s see if that trend holds steady for every running back.

Click here for this table in a graph.

The vertical lines on the graph show the values at age 29 and 30. You can clearly see that each stat falls after a running back’s age-29 season, but is the myth that 30-year-old running backs see a dramatic decline any true?

Not really. Age-30 backs lose 1.26 percent off their yards per attempt (.937 divided by .949 in the table above, then subtracted from one) and 2.13 percent of their touchdown rate (.862 divided by .881 and subtracted from one)—a drop of 15 yards and one-fourth of a touchdown for a running back with 1,200 yards and 12 touchdowns.

To put it bluntly, don’t downgrade LaDainian Tomlinson, Brian Westbrook, Jamal Lewis, or Larry Johnson on your running back rankings because they are turning 30. That is, unless you’re afraid of losing less than three fantasy points over the course of a season.

Running backs tend to peak around 22 to 25, specifically at 23 and 24. Fantasy points per attempt seem to have, more or less, a triangular pattern from 21 to 26, but then it ever-so-slightly increases with no set pattern until age 32.

This can most likely be attributed to selective sampling. The longer a running back plays, the more chance for them to peak later in their careers, a la John Riggins.

In addition, if a guy is playing into his early-to-mid 30s, chances are he’s been productive late in his career; if a guy fades away at age 31, with, say, a drop of 500 rushing yards from his previous year, he’s going to get little carries the next year—if he isn’t retired by then.

Running backs have a very short period of increasing performance. Rushing yards per carry increase from 21 to 22, but decrease all but two of the next 11 years; touchdowns per carry increase from 21 to 23 but decrease four of the next five years.

Of course, the largest overall increase for a running back is between his age 22 and 23 seasons, in which his touchdowns go up almost 12 percent and fantasy points increase by 2.7 percent. (Rushing yards, however, decline by about 1.2 percent.)

Steve Slaton, Marshawn Lynch, and Kevin Smith headline this year’s age-23 class. That said, don’t expect a huge breakout: If we adjust each of their 2008 stats based on their expected increase, all of them would have a four- or five-point increase in fantasy points.

Neither Slaton nor Smith would have their rank among running backs in fantasy points changed, while Lynch would move up three spots from No. 15 to No. 12.

Thirty-two-year-old running backs had the biggest decline in production, losing 10 percent of their yards per carry, 16 percent of their touchdowns, and 12 percent of their fantasy points. This year, however, only two New England backs are turning 33: Fred Taylor and Kevin Faulk.

I think it’s safe to say that neither will perform as the top-10 backs you expected in May.

Wide Receivers

Conventional wisdom says that wide receivers have a longer peak than most other positions.

Take one look at the best receivers in the NFL today—Larry Fitzgerald, Randy Moss, Steve Smith, Reggie Wayne, Chad Johnson, to name a few—and it becomes clear that the best wideouts typically have numerous 1,000-yard seasons during their prime.

The numbers, unsurprisingly, back up this notion.

A graph of this data can be found here.

Wide receivers have the latest and longest peak of any skill position. Their best year is at age 27, but ages 24 to 30 aren’t far behind. In fact, in terms of yards per receptions, all but one of those six years (excluding age 27) are within one percent of the peak level.

In other words, a wide receiver with a true talent level of 1,000 yards in a constant number of catches will be within 10 yards of that level all but one year from 24 to 30. (He’d be within 13 yards in that one year.)

This also suggests that a receiver’s breakout or banner year is more reliable in establishing a new talent level compared to those of quarterbacks or running backs. (As well, receiving yards per catch has a higher year-to-year correlation than any passing or rushing stat.)

A receiver’s largest statistical jump unquestionably occurs from age 23 to age 24, when yards per catch increases by 3.2 percent and touchdowns per catch goes up 7.7 percent.

That means a receiver with 1,200 yards and seven touchdowns—who’d rank No. 12 among receivers in fantasy points—would gain almost 40 yards and half a touchdown (seven fantasy points), and would jump four spots to No. 8.

If you didn’t respect him before, it’s hard not to now: Calvin Johnson is turning 24. The second-year receiver finished fifth in the league in receiving yards with 1,331 and tied for first in receiving touchdowns with 12. In addition, Johnson’s average of 17.1 yards per catch was the second-highest of any receiver with 60 catches since 2006.

Applying the aforementioned age adjustments, Johnson gains over 40 yards and one touchdown to his already absurd statistics.

Another receiver turning 24 is Miami’s Ted Ginn Jr. The ninth pick in the 2007 draft, Ginn started 14 games last year and caught 56 balls for 790 yards, 570 more than his rookie season total. Ginn finished No. 33 among receivers in fantasy points last year, but most Web sites rank him around No. 40 for the upcoming season.

Ginn could beat out those prognostications by a large margin if the age-24 increase comes about.

Interestingly, both Johnson and Ginn are also entering their third season. We hear fantasy analysts claiming that receivers break out in their third season, because it takes two to acclimate to the NFL. Is this belief actually a renaming of the age-24 jump?

If so, the increase from a receiver’s second to third season would not be as large as the increase from age 23 to age 24.

And we see just that.

You can find a graph of this data here.

A receiver’s yards and touchdowns both peak in their third year—though that doesn’t necessarily confirm the myth. From their second year to their third, wideouts gain 1.4 percent to their yards and 4.2 percent to their touchdowns, compared to 3.2 and 7.7, respectively, from age 23 to age 24.

It appears as if the third-year wide receiver myth is actually the age-24 increase in disguise.

How NFL Statistics Lead to Wins, Part 3: Salary Cap Efficiency Since 2000

Published: June 20, 2009

Even an incompetent owner can spend money. It takes an intelligent one, on the other hand, to spend that money efficiently.

In a time when multi-billion-dollar entities are going bankrupt, teams are looking to spend less money on free agent signings and draft picks.

The Tampa Bay Buccaneers, for instance, were $38 million under the cap prior to free agency. They re-signed just six of their 12 free agents and signed just five others, only one of which—running back Derrick Ward—has a chance to start.

In mid-May, Tampa Bay was sitting at $37 million under the cap, and since then the only transaction they’ve made was signing their fifth-round pick, offensive tackle Xavier Fulton, to a $1.93 million deal with a $181,000 signing bonus.

The Eagles weren’t any better: Sitting $29 million under the cap, Philadelphia re-signed one of their five free agents, wide receiver Hank Baskett, to a one-year deal.

Of their other four free-agent signings, only one was signed to a multi-year deal: tackle Stacy Andrews, to a six-year deal reportedly worth $42 million.

Though they traded for tackle Jason Peters and agreed to a six-year, $60 million contract, Philadelphia currently has $30 million in cap space, according to Pro Football Talk.

More than ever, franchises are cutting back on spending, even making moves to simply reach the salary floor.

But, nevertheless, owners and presidents still want the results on the field; they aren’t tanking games at the expense of saving a few million dollars here and there.

No, they aren’t hoping that their lack of expenditures leads to a lack of wins, but merely a cost-efficient approach of getting into the playoffs.

In the final part of this series, we’ll measure which teams are the best at spending as little money as possible to get the results the fans want. Which teams get the most bang for their buck?

I pulled salary data from USA Today’s salary database for every player since 2000. I then totaled up the cap values for each team, as well as the cap value of offense and defense, respectively, and normalized these values based on the year.

(Note that the sum of a team’s player’s cap values are not the same as its total payroll as noted by USA Today—the sum of total salaries is. But total salary, as shown, includes a player’s full signing bonus, so a guy like Ben Roethlisberger, who had a $25 million signing bonus but a cap value of just $7.97 million, has a total salary north of $27 million. As well, the total payroll went over the 2008 salary cap of $116 million for 13 of 32 teams and does not reflect a team’s actual salary.)

Then, using the regression equation in Part 2, I calculated the wins (we’ll call them xWins)—and, like the team salaries, the xWins from just the offense (xOW) and defense (xDW), respectively—for every team since 2000 and compared salary to wins as well as many other stats of note.

Let’s start with individual team seasons. Do the undefeated 2007 New England Patriots come in as the most profitable team of the century?

In the table below, you’ll find the top 10 and bottom 10 teams since 2000 in each of eight different stats. To find cost-efficiency, salary is divided by xWins—the less a team spends per win, the more economical it is.

I have also included efficiency for both sides of the ball as well. For defense, however, xDWins are first added to games played before being divided by defensive salary. Why? Here’s an example:

Team A spends $50 million on defense, and its defense is worth minus-8 wins; their salary-per-win would be minus-$6.25 million.

Team B spends $60 million on defense, which is also worth minus-8 wins; their salary-per-win is minus-$7.5 million. Team C spends $50 million and gets back minus-10 wins from their defense; their salary-per-win is minus-$5 million.

Team A is obviously the most cost-efficient, but their money-per-win is in the middle of the three teams; there’s no way to sort them for A to come out on top.

By adding 16 to each team’s xDWins, Team A’s defense comes out with the lowest salary-per-win of the three teams. (The 16 is a fudge factor, yes, but it’s the only way to come up with correct results using the salary-per-win method.)

All dollar values are in millions of dollars.

Key:

$/W: Salary per xW

O$/W: Offensive salary per xOW